You might be using techniques like prepayments, recurring journals or manual journals to spread expenses (rent, insurance, and utilities etc.) or revenue across the periods where it was incurred or earned. Dynamics NAV 2017 introduces a new feature called ‘deferrals’ to simplify this common task.

This blog post describes the setup and processing of a basic expense deferral – such as prepaid annual rent – across 12 months.

Preparation: Create a G/L Account for Deferred Expenses

Deferrals require a balance sheet G/L account. In the case of the prepaid rent, this will be an asset account and could be titled Prepaid Expenses as an example. Later in this post, I will explain the rules for how this account is used.

Preparation: Create a Deferral Template

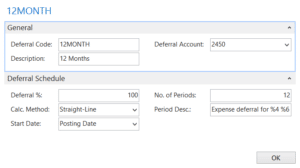

Open Deferral Templates in NAV and enter these details to create a basic schedule that will spread an expense equally over 12 months:

Post a Deferral Purchase Invoice

To spread prepaid rent for a year across 12 months, follow these steps:

- Create a new purchase invoice and key a line for your rent expense account.

- Enter the Deferral Code of 12MONTH on the line.

- Click the Line button > Deferral Schedule to review the proposed deferral postings. Below is the NAV screenshot for spreading $10,000 across 12 months.

Edit the dates, amounts, descriptions for any deferral lines if desired. - Use Actions > Preview Posting and then Show Related Entries to view the resulting G/L entries

- Post the invoice.

Deferral Accounting Rules

In our 12-month prepaid rent example, the following accounting has occurred:

- Debit Prepaid Expenses $10,000

- Credit Payables $10,000

- At the start of each of the 12 periods:

- Credit Prepaid Expenses $833

- Debit Rent Expense $833

After 12 periods, nothing remains in Prepaid Expense – it has been fully transferred into the Rent Expense GL account.

Review Posted Deferrals

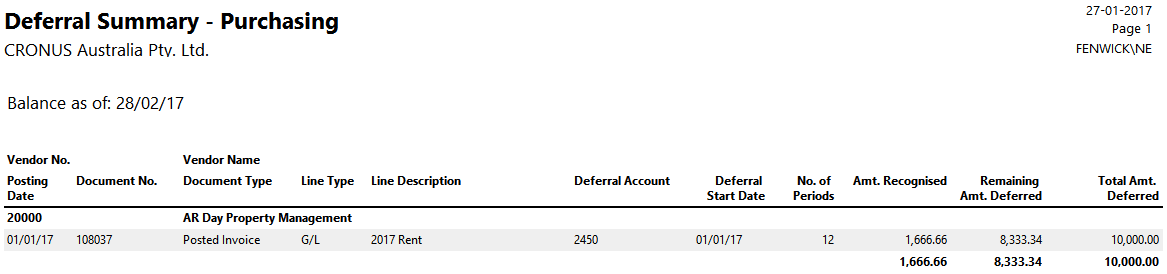

Use the reports ‘Purchase Deferral Summary’, ‘Sales Deferral Summary’ and ‘G/L Deferral Summary’ to view the balance-at-date of your deferrals. Here is the same example from above, after a couple of months:

Other Features

General Journals and Sales Invoices

We used a purchase invoice for our example, but deferral codes can be entered on sales invoices and general journals to achieve the same result for other types of transactions.

Flexible Configuration

Deferral templates can be configured in many ways:

- Defer part of an amount by using Deferral %

- Change the Calculation Method to apportion amounts equally, per the days in each period or even force the user to manually enter an amount for each period

- Control the posting dates of the deferring entries choosing different Start Date methods

Default Deferrals

Default deferral templates can be attached to items, resources and G/L accounts. This will save you time and can simplify the entry of deferrals if they are regularly used in transactions.

Additional Reading

Find more information and training material on deferrals, click here.

Read more about the new features in Dynamics NAV 2017 in Jake Edward’s helpful blog post.